Natural disasters can be heartbreaking and terrifying! If you live in a natural disaster-prone region, you should take steps to prepare for the worst. Of course, there are lots of things involved in preparing for a natural disaster. For example, many homes across the country keep supplies for emergencies. Others, who are concerned about the safety of their home, get prepared for the adverse effect of the natural disaster by relying on insurance to cover the financial fallout. Unfortunately, there are some situations where insurance isn’t sufficient. At Claim Check Consultants, we have outlined three insurance pitfalls you should avoid and what you can do. So, if you consider insurance as one way to prepare for natural disasters, these points are worth noting.

Natural Disaster Exceptions

Many insurance policies are selective regarding the type of damages they can cover. Some outrightly exclude natural disasters. For instance, some policies won’t cover any damages that result from wind-blown objects, even when it’s clear they are from a storm. Most policies wouldn’t even cover flood damages and earthquakes. Thus, if you depend entirely on the general homeowner’s insurance to cover these damages, the outcome might unpleasantly surprise you. What can you do? Invest in specific insurance that will cover natural disasters that your area is prone to. For instance, if you reside in a coastal or floodplain region, request flood insurance from an insurance agent. So, the best approach is to seek insurance that is specific to each disaster. Lastly, make sure you are familiar with the insurance you are signing up for and know what your insurance plan will cover.

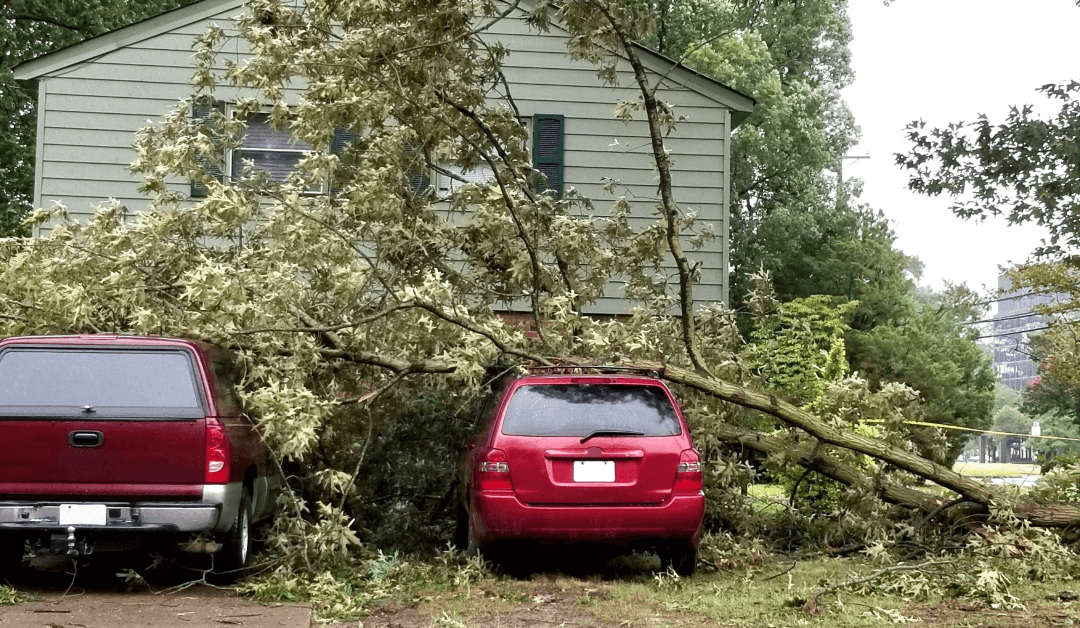

Unmaintained Trees

Trees that offer you unique shade can wreak havoc on your car, roof, or fence. It can even be so terrible that it will affect all of them. You might be surprised to hear your insurance company tell you that natural disasters don’t cause fallen trees, and they are inevitable occurrences. They could even deny those claims if those trees aren’t maintained. How do you work this out? Good maintenance. Make sure you hire an arborist. They are professionals who inspect, assess, and document the level of risk a tree poses.

Mortgage Clauses

While it is improbable that a mortgagee will object to insurance claims, their response might be delayed. This is because they have many claims to examine, and that will delay payments, leaving you out of your home at that moment. Therefore, the solution here is to practice self-insurance. Keep some funds aside to cover the repairs of the damaged facility while you await the completion of the insurance paperwork. Once that is completed, you can get your funds. That move is better than borrowing because your insurance company will not pay for any interest incurred. Thus, the best option is to have savings on hand.

Contact Us

Would you love to have the best Public insurance Adjusting company handle all your insurance claims? Contact us today at Claim Check Consultants Public Adjusters. With over a decade of unmatched experience offering value to our clients, we are ready to assist you on receiving the maximum compensation for your insurance claim.